how to avoid estate tax in california

Assets distributed through the trust are not subject to estate taxes. In California you can make a living trust to avoid probate for virtually any asset you ownreal estate bank accounts vehicles and so on.

California Estate Tax Everything You Need To Know Smartasset

1 Federal State and Inheritance Tax on House Rules Explained.

. Some clients decide to disclaim an inheritance in order to avoid the potential of owing estate taxes when they die. In 1978 the citizens of the State of California voted in an initiative to limit property taxation which is now embodied in Article 13A of the California Constitution Prop 13. 8 appeal by 915 of each tax year.

Well the best way to avoid capital gains tax for houses in. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year. However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US.

Number of Inherited Properties Likely to Grow. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Meanwhile California real estate taxes are maintained at a reasonable level by Proposition 13 which limits real estate tax increases to 2 maximum per year.

The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. California tops out at 133 per year whereas the top federal tax rate is currently 37. If you have additional questions please contact the Title Unit at 619 531-5557.

Also are property taxes in California tax deductible. So among its many benefits an ILIT can reduce state and federal taxes owed on ones yearly tax return. What property is taxed.

You have not used the exclusion in the last 2 years. Do you want to pay 14000 on a 200000 capital gain. Up to 25 cash back Living Trusts.

This tax has full portability for married couples meaning if the right legal. Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if. Your gain from the sale was less than 250000.

The IRS has a list of properties that have a tax and its important to take. From Fisher Investments 40 years managing money and helping thousands of families. 2 How to Avoid Inheritance Tax and Capital Gains.

Ventura CA 93001 4900 California Ave Tower A Suite 320A Bakersfield CA 93309 2436 Broad Street San Luis Obispo CA 93401 924 Anacapa St Suite 3H Santa Barbara. 40 on taxable amount. The estate tax is paid out of the estate so the beneficiaries will.

For the California residence it can pass from parent to child or child to parent without an. Do you know capital gains tax is so high in California. In contrast an inheritance tax is calculated based on the value of bequests.

You do not have to report the sale of your home if all of the following apply. For some people a substantial inheritance could result in. Estate tax is calculated based on the net value of all the property owned by an individual at the date of their death.

California Estate Tax. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. 12 What about capital gains tax.

In each tax bracket the estate pays a base tax plus the applicable rate on the income that falls within that bracket. The first step in avoiding capital gains tax is to understand what property has tax. How to Avoid Estate Tax 10.

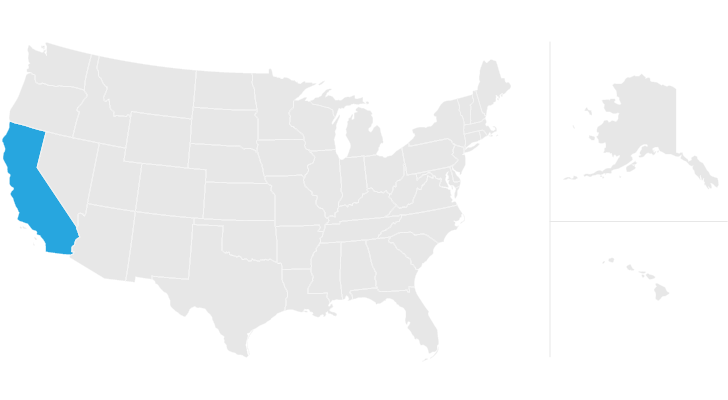

California does not levy an estate tax on any estates regardless of size. 11 Inheritance tax vs estate tax. Joint tenancy is appropriate only when each joint tenant in theory there can be any number ow.

The easiest but most commonly overlooked action is the filing of a Prop. Of increasing concern is how to avoid an increase in California real property tax. Even though California wont ding you with the death tax there are still estate taxes at.

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Avoiding Probate How To Fill Out A California Small Estate Affidavit Youtube

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp

How To Inherit Your Parents House And Their Low Tax Bill Too

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Tips For Getting Your Spouse On Board With Divorce Mediation More Tips Here Childcustody Alimony Spousalsup Divorce Mediation Cost Of Divorce Mediation

Wills And Trusts How To Plan Your Finances For When You Re Gone In 2022 Financial Gift Funeral Costs Funeral Planning

Is Inheritance Taxable In California California Trust Estate Probate Litigation

The Property Tax Inheritance Exclusion

California Estate Tax Everything You Need To Know Smartasset

California Decedent Estate Practice Legal Resources Ceb Ceb

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Fun Facts About Estate Planning Infographic Estate Planning Infographic Estate Planning How To Plan

Brokers Welcome Buying New In Southern California February Edition Www Tripointehomes Com Now Is The California Real Estate New Home Builders California

California Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

5 Reasons You Should Sell Your Mobile Home To Sell Thy House In Southern California Avoid Foreclosure Sell My House Sell My House Fast