capital gains tax proposal effective date

The effective date for most of the proposals is Jan. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

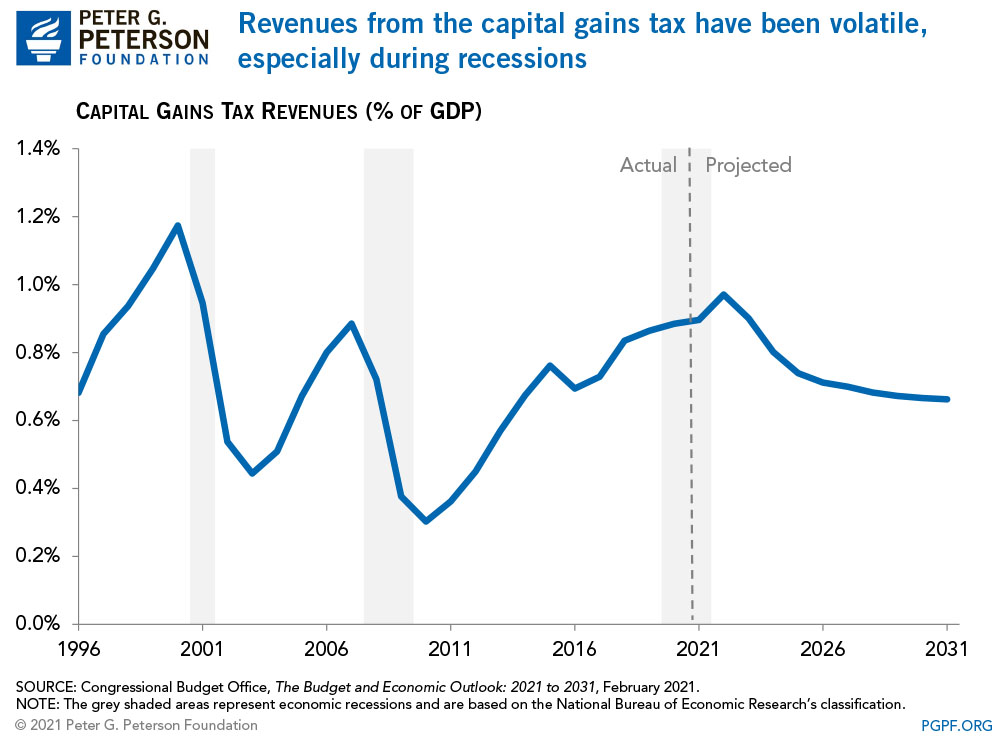

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Bidens Capital Gains Proposal.

. In short we dont yet know the answer to this important question. Check if your assets are subject to CGT exempt or pre-date CGT. The effective date for the proposal would be the date of enactment.

If this were to happen it may. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021. The effective date for most of the proposals is Jan.

This may be why the White. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial.

While this will often be the case. This proposal would be effective for. By QSBS Expert.

1 2022 with some exceptions he said. As American taxpayers await the unveiling of the Biden Administrations tax proposal investors cant help but uneasily imagine the effects it will have. Raising the top capital gains rate for households with more than 1 million.

President Biden has proposed a substan tial increase in the capital gains rate. More than five months ago. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that date would.

The Green Book says this. It is generally assumed that for tax purposes a capital gain or loss arises in the year the sale contract is entered into. The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

Effective Date Considerations May 14 2021. The House bill would apply the increase. CGT Contract date or settlement date.

Ii The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced.

Which leads to the oft-asked question of when. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk.

It appears that the White House is planning to make the effective date for its proposed tax. The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Managing Tax Rate Uncertainty Russell Investments

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Capital Gains Tax In The United States Wikipedia

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden S Capital Gains Proposal Effective Date Considerations

How Are Capital Gains Taxed Tax Policy Center

Biden Capital Gains Tax Rate Would Be Highest In Oecd

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Preferential Capital Gains Tax Rates

Proposed Tax Changes For High Income Individuals Ey Us

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Advisers Blast Biden S Retroactive Capital Gains Proposal

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World